A Break Down of the Year and a Closer Look at My Trading Strategy

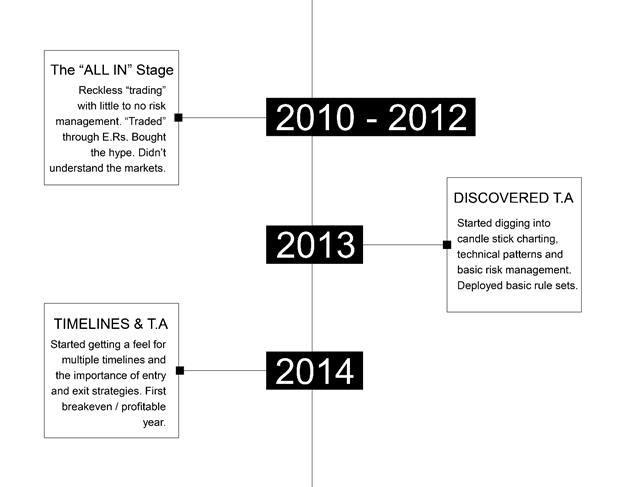

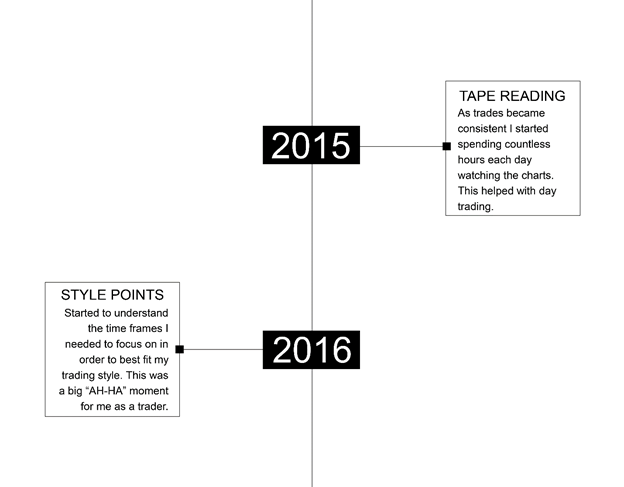

I Figure that this would be a great place to talk about my 2021 year in the market. From a yearly percentage return perspective this has been a personal best for me! I’ve been actively involved in the markets since late 2009 / early 2010 and since then I’ve been continuously honing and improving upon what defines me as a trader.

Previous to joining the Art of Trading I had tried a few other services with not much success. What I was really seeking was a mentor of sorts. the Art of Trading ended up being what I was looking for. The reason I wanted to join was because I had already spent so much time on my own looking at one angle of the market that I thought it would be more productive if I was able to mimic the style of someone else and build off of it. My end goal was to be able to take everything I liked about Trader Stewie’s swing trading, and mesh it into my day trading style, then eventually create a hybrid style of sorts. I wanted to create a strategy that worked well in a variety of market conditions. I was able to achieve this with his hands on approach and his willingness to help!

In 2020 I wrote a post, here on my blog titled “Multiple Perspectives – The Art of Trading: How the Art of Trading Facilitated my Growth as a Trader!” I think its very important to revisit this post because a lot of what is contained in that post is still relevant today. 2022 will be my 4th year as a member in the Art of Trading, and a major part of my success comes from here. The development of my strategy consists of bits and pieces of Trader Stewie’s strategies plus strategies that I have worked on over the years and built myself.

For the first time I would like to share the strategy that I have developed and how I was able to return 114%+ in 2021!

What does my strategy look like, what are the rules and how does it work?

I like to call my trading strategy the Stair Trading Strategy (S.T.S). The strategy in its best form uses the power of swing trading combined with day trading. It is built around taking day trading profits defined by a dollar value from the market on a daily basis. The primary purpose of the day trading profits in trending markets is used to manage risk on open swing trading positions and at the same time reduce over night exposure risk. In higher volatility markets without a clearly defined trend or markets with heightened over night risk the swing trading aspect of the strategy is turned off, and the primary focus becomes day trading.

Each day I come into the market I’m looking to build steps. The best way to picture this strategy is a set of stairs that you’re trying to build. Each step is a defined dollar value based on the account size. The steps define risk for both the swing trading and day trading strategies.

Here is the defined risk for the day trading strategies:

1 Step = 0.25% of the total account value.

1 Step also equals your maximum risk per day trade. I aim for 1:1 Risk vs Reward on day trades.

The defined risk for the swing trading strategies is:

4 Steps = 1.00% of the total account value.

4 Steps also equals your maximum risk per swing trade. I aim for 1:3 Risk vs Reward on swing trades.

If you picture the basic risk profile of the strategy this is what it looks like.

Each day I come into the market I’m looking to build steps through day trading. My goal each day is to build 2 – 3 steps through day trading. As stated before, each one of these steps is a defined percentage of the account which is obviously equal to a dollar value. Let’s assume the dollar value is $500 per step. (This is scalable with the account, for example of the account was $400k in size each step = $1k risk). The types of day trades I look for are Red 2 Green moves, Green 2 Red moves, avalanche trade setups and opening range breakout trades. I also focus on intraday support and resistance levels for trading choppy ranges in range bound markets. This is all done on 5-minute time frame charts.

I size the day trades around 25% of the account value, and on average I look for 1% +/- moves. If the day trade pops quickly, I size out half immediately and then set my stop to the entry price. My goal is to net money with these strategies. I take money from the market as soon as it makes it available to me. I’m very aggressive with this. These short-term day trading and scalping strategies are fast moving. I’m watching the charts and PnL closely. Its important. Some say “rely on the process and remove PnL from the screen” guess what, it doesn’t work for this!!! You have to be quick, nimble and open minded or else I can almost guarantee you; you won’t consistently make money doing this.

The purpose of the day trading strategy in trending markets is to create a cushion for your swing trading trades. Day trading doesn’t present any over night risk where as swing trading does. Your day trading profits reduce your overnight risk as you’re using the intra-day gains to cushion the swing trade. When the market is range bound, choppy or higher volatility your primary focus becomes this day trading strategy and you stop swing trading.

The swing trading strategy is built around Trader Stewie’s Power Earnings Gap system. I’m looking for the strongest stocks in the market to swing trade. Usually, I’m only holding around 2 swing trades over night in a trending market. Names like $TSLA, $AAPL, $NVDA the BEST of the BEST. I also swing leveraged ETFs such as $SPXL, $TQQQ and occasionally $TNA. Again, I’m using my day trading gains to cushion my swing trading positions. In strong trending markets I will treat my initial buy in on my swing trade as a day trade. Looking to reduce half of the exposure as soon as I can with a slight profit to reduce over night risk, and to take money from the market as soon as it makes it available to me. I use 5-minute time frames for the entry then I map out support and resistance levels on 15/ 30/ 60/ and daily time frame charts. I Closely watch these price levels that I map out to see how support and resistance is acting. As soon as I can minimize downside risk through profit taking, I do and then I raise my stop loss to breakeven.

To summarize the strategy into point form it looks like this:

Day Trading component:

- Take day trades each day with 0.25% (1 step) account risk exposure and look to make 1 step.

- Aggressively take profits on day trades and reduce risk as soon as possible through profit taking

- Aim for 2-3 steps a day in order to reduce down side risk on swing trades.

- In markets with heightened volatility, choppy conditions, day trade only. No overnight exposure.

Swing Trading component:

- Use the biggest market cap power earnings gap stocks as a focus list

- Size the trade with 1.00% account downside risk (4 steps) and look to make 10~ steps.

- Reduce the trade by half as soon as the downside risk is covered.

- Use day trading steps in order to cover overnight risk on the trade.

- In markets with heightened volatility, choppy conditions no swing trading. Day trade only.

I’ve been deploying this strategy I’ve outlined here to a single account since January 2019 (I have other accounts but this one has been my primary focus) Here are the results.

This year was the year when my Stair Trading Strategy (S.T.S) Really shined. I think in part this was because I had the working capital to be aggressive with it, but I also knew exactly what I was trying to accomplish. I stuck with it and it paid.

I think the biggest take away from this is, I was actively day trading momentum stocks January through mid February but I was deploying my rules, and taking money from the market when it was made available to me.

I had a few bumps a long the way, but for the most part I kept things in check and traded my way back into highs each time. Moving forward, I think I need to become better at identifying short term tops in the market quicker so I can move into my day trading component of the strategy a little quicker. My results would have been better this year if I identified these conditions sooner.

A few side notes about my strategy. I also have max daily drawdown rule which sits around 2% of the total account maximum. Occasionally as traders we get caught in bad trades or we’re sloppy in our approach. THESE THINGS HAPPEN. Identifying the problem before making it a bigger one is key. I also have a 2% account increase rule where if we’re in choppy conditions but some how my daily execution is perfectly executed, I will take the gains and move on.

I would have never been able to get to this point trading on my own. The Art of Trading took me from an average day trader to the point in which I could take multiple strategies and combine them into my own hybrid strategy that produces REAL WORLD consistent results. I’m happy to share these results because they’ve made a positive impact on my life, and it shows that hard work and dedication really pays off!

Happy New Year and all the best in 2022!